Why China is a lucrative market for dental implant manufacturers

The Chinese dental implant industry has shown strong growth in recent years, and the trend is expected to continue. As the Chinese population is experiencing increased upward mobility, more people can afford dental care, and the demand for restorative dental services is increasing. As a result, China has become a lucrative market for dental implant manufacturers.

A glance at the dental implant market in China

The Chinese dental implant market size is expected to grow and reach a valuation of nearly $680 million in 2027. The expected market increase is setting the stage for lucrative opportunities for dental implant manufacturers.

The proportion of dental implant procedures performed in private dental clinics is much greater than that of government-owned public hospitals in some regions. However, this split differs between Northern/Southern and Eastern/Western regions. On average, across China, the total number of dental implant procedures performed in private clinics versus public hospitals is almost fifty-fifty.

With an almost equal distribution of procedures taking place in clinics compared to hospitals, it would seem logical to deduce that clinics and hospitals are equally desirable for implant manufacturers to focus on. However, this is actually not the case.

Private dental clinics versus public hospitals

Public hospitals are a much more lucrative segment for implant manufacturers to target to substantially grow their business in China. Public hospitals are considered the most reliable and qualified treatment centers among patients and the prime segment for premium foreign brands today. Consumers have greater confidence in public hospitals, and the best dentists want to work for public hospitals – not private clinics.

More than 50% of dental implant sales today already target hospitals as their prime segment. This market is estimated to win an even greater market share from private clinics in the future. Furthermore, most dental implant companies are persistent enough to put in the effort to succeed in public hospitals due to their strong influence, academic status, and better gross profit margin.

Foreign versus domestic dental implant brands

It is also key to know that Chinese patients prefer foreign brands over Chinese brands. In fact, more than 90% of dental implants in China are provided by foreign brands today. Furthermore, Chinese consumers prefer American and European brands over all others as they are known to be market leaders in the dental industry with safe, high-quality performance.

The high trust in foreign brands means excellent opportunities for dental implant manufacturers in the Chinese market. However, as a foreign brand in China, you need to understand the regulatory challenges and new policies to compete.

Regulations for dental implants in China

The NMPA (National Medical Products Administration) has launched new medical device regulations that pose threats to foreign dental implant manufacturers.

In early 2021, a proposal was submitted to the National People’s Congress mentioning the high cost of dental implants for the first time at the national level. Later that year, a notification was issued by the Pharmaceutical Equipment & Procurement Service Center of Sichuan Province. It stated that information collection of high-value medical consumables in the dental category would take place. This included dental implants, repair abutments, prosthetic products, and other medical consumables that constitute dental implant systems.

In 2022, an executive meeting of the State Council was held to deploy and accelerate the major projects identified in the outline of the 14th Five-Year Plan, covering the years 2021-2025. At that time, it was announced that dental implant systems would be included in the program of volume-based procurement on a national level.

State order 739 is the approval for the new Regulations on the Supervision and Administration of Medical Devices, which is now publicized and took effect as of June 1, 2021, with an enforcement date of January 1, 2022.

Classification is key to the Chinese dental market

Although the official reasoning behind the new policy is a reduction in the cost of the medical burden on patients, Elos Medtech assesses that the policy will be much more detrimental to foreign dental implant brands sold in China than meets the eye. The new policy incentivizes the protection of domestic brands in China, the localization of dental products, and the development of China’s technical knowledge in the dental implant industry.

Our assessment of the new policy’s regulations is that it is becoming imperative to become classified as a domestic brand in China, acting as a Legal Manufacturer to be able to sell dental implant products in public hospitals in the future.

And in the most recent move, on August 18, 2022, the Chinese National Health Care Insurance Association solicited public comments on the Notice on Carrying Out Special Governance of Oral Implant Medical Service Charges and Consumables Prices. This notice regards the pre-stages of the procurement of implantology. It shows that the government is working swiftly to accelerate the implementation of its implantology plan. Notably, this notification relates to both public and private clinics.

Opportunities for dental implant manufacturers

It is vital to act quickly to avoid being left out of such an important market, and Elos Medtech can help. For more in-depth information and strategies to help ensure your brand’s success in China, visit Elos Dental, where you can also download our eBook.

Yes, I want to enter the lucrative dental implant market in China!

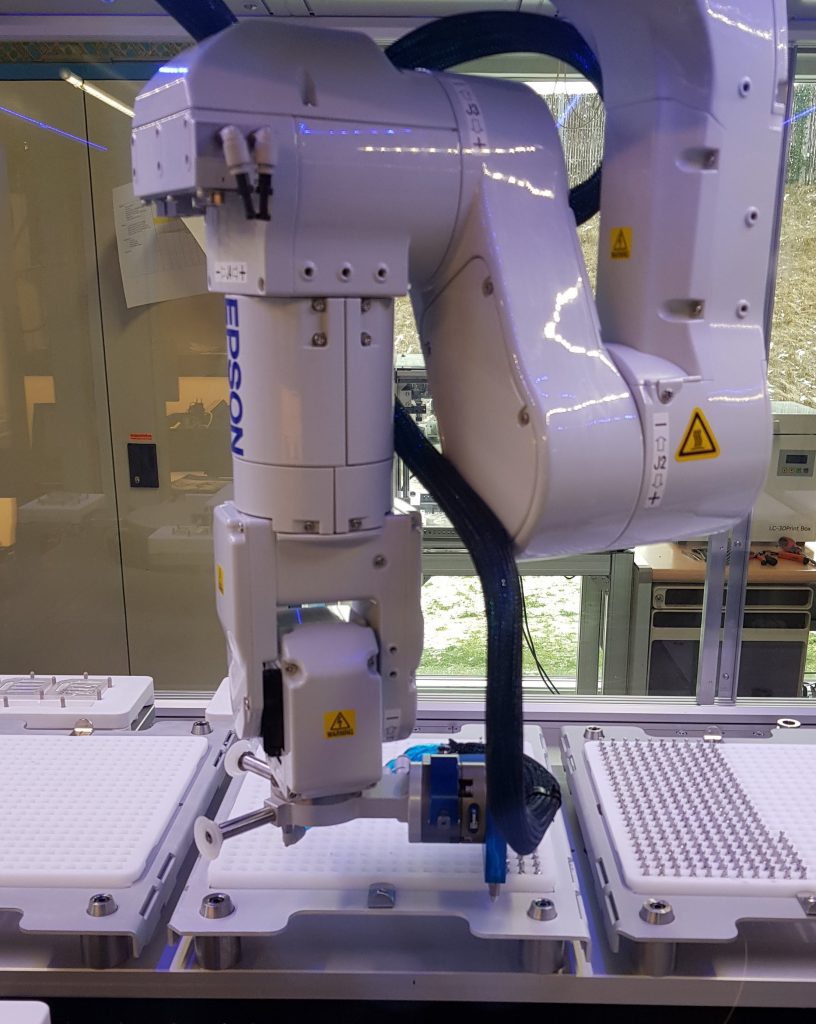

In the Bonezone article, Jodie states that the global focus that Elos Medtech has had during recent years has provided us with a lot of new opportunities to meet customers’ needs. Also, we see an increased demand for drills, pins, wires and screws in both traditional trauma and robotically enabled surgery. As a result, Elos Medtech is in the process of a significant expansion of the U.S. facility. By nearly doubling our current manufacturing space and investing in new equipment and employees we will increase our capacity to support customers in the global orthopedic market.

In the Bonezone article, Jodie states that the global focus that Elos Medtech has had during recent years has provided us with a lot of new opportunities to meet customers’ needs. Also, we see an increased demand for drills, pins, wires and screws in both traditional trauma and robotically enabled surgery. As a result, Elos Medtech is in the process of a significant expansion of the U.S. facility. By nearly doubling our current manufacturing space and investing in new equipment and employees we will increase our capacity to support customers in the global orthopedic market.

Swemac identified the need to further develop the Hansson Pin and make it even better, to provide the patients with even more benefits. Instead of the two isolated pins constituting the Hansson Pin,

Swemac identified the need to further develop the Hansson Pin and make it even better, to provide the patients with even more benefits. Instead of the two isolated pins constituting the Hansson Pin,