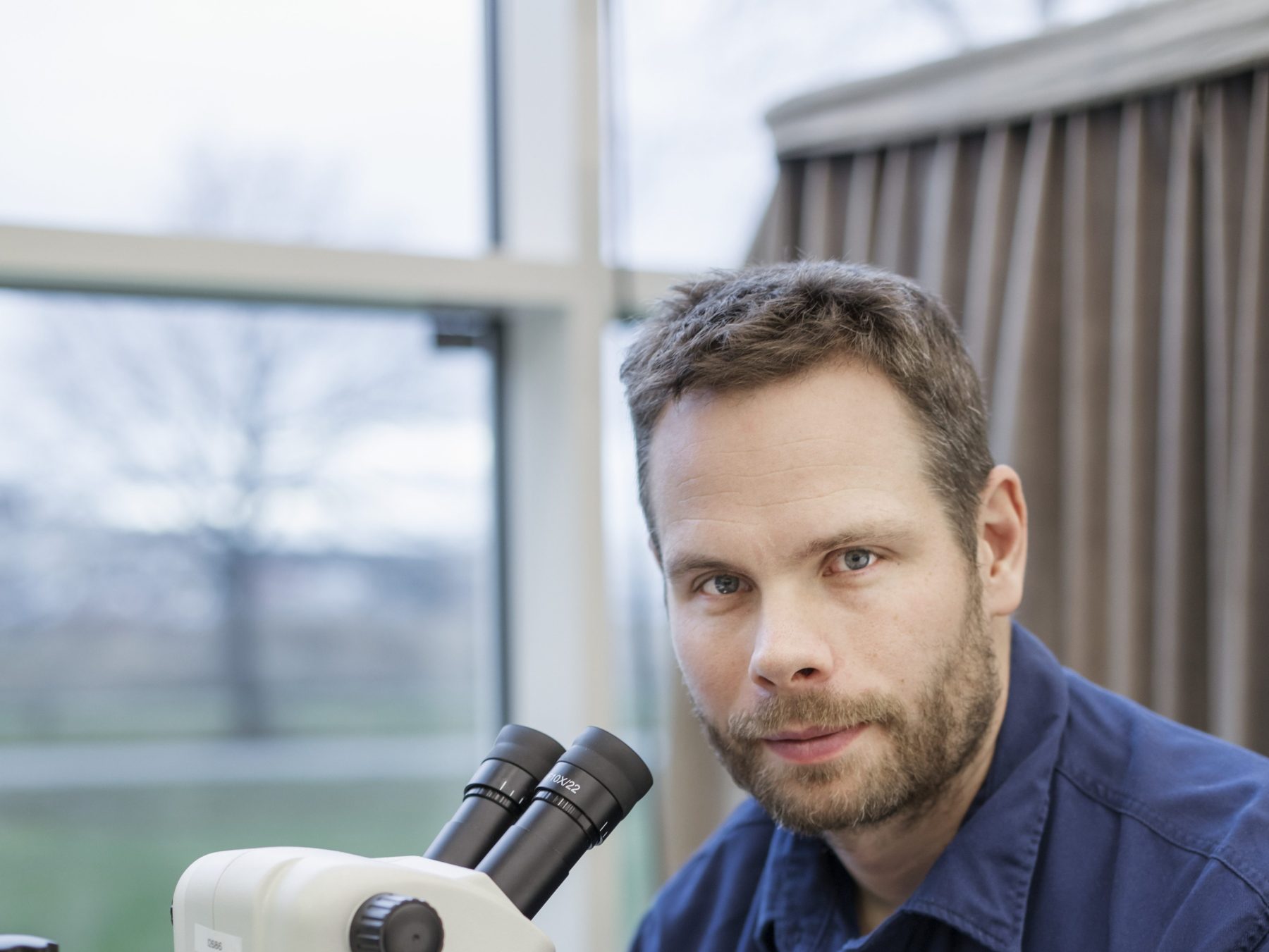

Celebrating Women in Science: Maria Sköld

“To be able to share my knowledge and be an important part of the supply chain for IVF treatments, blood tests, allergy tests and other medical technology products – it’s such a luxury!”

Quality Manager Maria Sköld’s journey in science and technology started at Elos Medtech Skara, Sweden, in 1999. Until then she had little knowledge about the manufacturing of medical polymer solutions or how they can help people.

Quality Focus

As Quality Manager, Maria does everything from article preparation, deviation investigations, producing instructions and answering questions from production while planning and maintaining the QMS.

She began as an operator in the post-processing department and progresssed to different roles within the company over the years. After the Skara entity became part of Elos Medtech AB in 2011, Maria was promoted to quality coordinator and that’s where her career within quality really began in earnest.

Maria spent six intense months establishing all routines, procedures and templates to certify the factory against ISO 13485. In 2012, Skara – together with the other companies in Elos Medtech AB – was included in the common ISO 13485:2003 certificate. A victory for Maria and the whole quality department.

In 2018, Maria was promoted to Quality Manager, a highlight so far in her career. Since then, the company has undergone several major audits by both FDA, BSI and DNV, with successful results. But she is careful not to take all the credit.

“Here in Skara, we have a ‘watchword’ that has followed us all these years and that is quality. Who is responsible for the quality? We all are!”

Customer and Togetherness

Quality is obviously always top of mind for Maria’s team – but she’s also keen on applying the company’s values in her daily work. Living up to the Togetherness value she tries to be a present manager and to have regular contact with her colleagues every day.

At Elos, the customer is at the heart of everything we do. Creating trust between customer and supplier should always be prioritized and maintained. This is in Maria’s back bone as she has several ongoing customer projects at all times.

“Credibility is the most important part of any relationship. Meeting new and old customers who request new products with different technical solutions – that’s what makes my work interesting and different every day.”

Personal Achievements

When she’s not working, Maria indulges in sports preferably outdoors as she loves the nature. She and her family share several interests such as traveling, skiing, playing padel and golf.

“I do have a few secrets that I am very proud of! One is that I have actually done three HIO (Hole In One) during my ‘golf career’. And in 2024 I completed the 90 km long skiing competition ‘Vasaloppet’, together with my son.”

Future

Going forward, Maria hopes that the company continues to challenge themselves by manufacturing more products, creating new production methods and developing new technical solutions. She also sees herself as a part of the continued success at Elos Skara.

Being able to participate in the manufacture of products that can help another person to a better life is what gives her the inspiration and energy to continue looking forward to what awaits in the future.

“One of our former board chairmen once said to us at an inauguration of new premises, ‘All you who work here in Skara should be so proud. You help create lives and you save lives with the products you manufacture!”

Working at Elos Medtech

Maria has never regretted embarking on a career in science. So what would her advice to young girls, wishing the same, be?

“Be curious, dare to ask and believe in yourself! To have the chance to develop and share knowledge with others is honorable. Take the chance – the industry of technology and science is incredibly exciting!”

Elos Medtech actively works towards attracting students to pursue careers in technology and engineering through close cooperation with other members and engagement initiatives, for example partnering with the University of Skövde. The company is also adamant about breaking down gender barriers in the tech world for young women aspiring to careers in science, technology, engineering, and mathematics (STEM).

Want to join the Elos Medtech team? Learn more about our opportunities here: https://elosmedtech.com/careers/